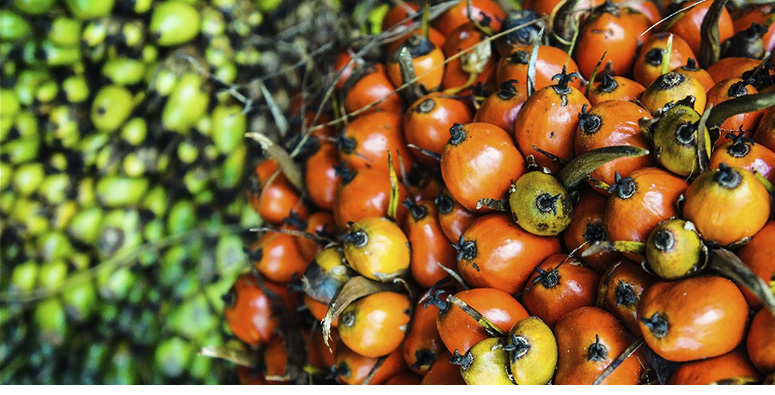

PHYSICAL PRODUCTS > PALM OIL

Palm Oil

About Palm Oil

Palm oil can be used to produce biodiesel, which is also known as palm oil methyl ester. And with the advent of biodiesel, palm oil has now become a component product in the energy family. Palm oil biodiesel is often blended with gasoil or diesel to create biodiesel blends. Palm oil biodiesel meets the European EN 14214 and American ASTM standard for biodiesels.

Considering this complex nexus and price volatility of both palm oil and energy prices, or more simply, the relative price between the fuel product (determined by energy prices) and the feedstock crop or derivative (determined primarily by its competing demand for food and feed uses), requires a deep techno-commercial understanding of both markets. Ginga is in a position to source for palm oil products and biofuels that meet the stringent requirements of buyers in Asia, the EU and USA, including the environmental sustainability of these products. Ginga also brings its wide experience in hedging and risk management in petroleum and palm oil products into the marketplace. Ginga offers both broking services for the physical and paper products of palm oil.

PHYSICAL

• Crude Palm Oil

• Refined Palm Oil products (Olein, Refined Bleached and Deodorized Palm Oil)

• Other palm oil products

SWAPS

• Malaysian Crude Palm Oil Calendar Swap

Malaysian Crude Palm Oil (CPO) Calendar Swaps are USD denominated, centrally cleared at the Chicago Mercantile Exchange (CME), over-the -counter (OTC) contracts based on the monthly average prices of the Bursa Malaysia Derivatives Crude Palm Oil futures. Each USD Malaysian Crude Palm Oil Calendar Swap is based on the third forward BMD Crude Palm Oil Futures (FCPO) contract.

The contract specs are:

| Malaysian Crude Palm Oil Calendar Swaps | |

| Contract Size | 25 Metric Tons |

| Underlying Instrument | Bursa Malaysia Derivatives Berhad Crude Palm Oil Futures (FCPO) |

| Pricing Unit | U.S. dollars and cents per metric ton |

| Tick Size | USD $0.25 per metric ton ($6.25 per contract) |

| Contract Months | Calendar months, up to 24 months, replicating the listing schedule of the futures contracts offered by Bursa Malaysia Derivatives Berhad. |

| Trading Hours | The exchange shall determine the hours during which Malaysia Crude palm Oil Calendar Swaps may be submitted to the Clearing House. |

| Settlement Procedures | All contracts open as of the termination of trading shall be cash settled. The final settlement price shall be the cumulative average of the settlement prices for the third forward month FCPO contract traded on Bursa Malaysia Derivatives Berhad for each trading day in the swap contract month converted to USD and rounded to the nearest $0.25 using USD/MYR spot rate reported by Persatuan Kewangan Malaysia (PPKM), which appears on Thomson Reuters Screen MYRFIX2 Page at approximately 11:10a.m. Kuala Lumpur time. For example, final settlement for a January Malaysian Crude Palm Oil calendar Swap would be the cumulative average of the daily settlement prices for the third forward FCPO contract listed on the Bursa Malaysia Derivatives Berhad contract during the month of January, which in this example will comprise half of the March futures contract and half of the April futures contract, with the month roll determined by Bursa Malaysia Derivatives Berhad listing and expiration cycle. These daily settlement prices are converted to USD and rounded to the nearest $0.25 using USD/MYR spot rate reported by Persatuan Kewangan Malaysia (PPKM), which appears on Thomson Reuters Screen MYRFIX2 Page at approximately 11:10a.m. Kuala Lumpur time. |

| Last Trade Date | The contract shall terminate at the close of trading on the lat trading day of the swap contract month. |

| Ticker Symbols | CPC |

| Exchange Rule | These contracts are listed with, and subject to, the rules and regulations of CBOT. |

| Venue | CME ClearPort |